Disability Insurance

-

If you become disabled, your ability to earn income, ability to pay bills, or save for retirement can be compromised.

Accidents and illnesses are a fact of life and can happen to anyone at any time.

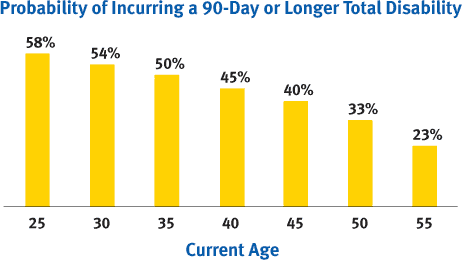

Consider the probability of incurring a 90-day or longer total disability prior to age 65(1) (see chart below). When a disability lasts longer than 90 days, the length of that disability averages between 2.1 and 3.2 years for those age 55 and younger(2).1) 1985 Commissioners Individual Disability Table A

2) 1985 Commissioners Individual Disability Table A: If the disability lasts longer than 90 days, the average length will be: 2.1 years for age 25, 2.5 years for age 30, 2.8 years for age 35, 3.1 years for age 40, 3.2 years for age 45, 3.1 years for age 50, 2.6 years for age 55, 1.6 years for age 60

-

Disability insurance offers you financial security in the event of an accident or illness that renders you unable to work or earn an income. Disability insurance plans ensure that you can concentrate on recovering from your disability, without the stress of income loss, until you are able to return to work. Whether your need is to protect your primary income or to supplement existing coverage you receive from your employer, group, or association, we can provide you with a reliable, comprehensive plan that covers you anywhere in the world throughout your working years.

Source: Compiled by RBC Life based upon 1985 Commissioner’s Disability Table A (Experience Table)

There are a number of plans available that can provide income protection for students, practicing professionals, business owners and business executives. Your disability coverage can be your financial lifeline in the event of an accident or illness; however, not all disability policies or carriers will cover you the right way. It’s important to devise your disability coverage properly, and choosing the right broker to educate you about these products is your first and most important step. A well-designed disability policy should offer you immediate protection as well as the flexibility to update your coverage as you progress throughout your career. At L.E.S. Financial we have the knowledge and experience to provide you with top-of-the-line plans at the lowest price available.

L.E.S. Financial has thousands of clients, and, unfortunately, claims are a fact of life. We handle each of our claims personally, which means we submit the disability claim, and we follow up and deal with the insurance company directly to ensure our clients can focus all their energy on their rehabilitation. Our extensive disability claims experience and our enduring commitment to the well-being of our clientele ensures that every claim will be dealt with quickly and smoothly. -

Types of Disability Plans

-

Your future income is your biggest asset, which means your Individual Disability Plan will be one of the most important insurance policies you own.

Your Individual Disability Plan pays you a tax-free monthly benefit to replace any income you might lose in the event of a sickness or injury. With a properly-designed disability plan, your coverage will increase as your income increases.

Request a Quote -

For the majority of you, you are the key to your business’s success.

If you are responsible for fixed expenses, the success of your business relies on your health and well-being. If you were disabled for any length of time, this could impact your business’s bottom line. In the event of a disability, the Office Expense Plan will pay for fixed business expenses, such as payroll, property taxes, rent and utilities.

Request a Quote -

Some of you may enter into business with partners, and the buy and sell agreements you draw up together are essential in the event of a disability.

These agreements outline the expectations of all those involved in the event of a disability. In accordance with the provisions of your agreement, this insurance plan can help provide the funds necessary to purchase the shares of a partner who can no longer work.

Request a Quote -

The Key Person Protector protects your business against the potential financial hardship caused by a long-term illness or injury of a key employee.

It also provides funds to help you secure a replacement of that key person. Benefits are payable directly to the business, not the key person.

Request a Quote -

Most of you will contribute to a savings plan like an RRSP.

In the event of a disability, your ability to save for your retirement can be significantly compromised. The Retirement Protector Plan will make contributions to your RRSP during a disability. This coverage will provide you with a sense of ease in knowing your retirement is being protected.

Request a Quote -

Loans must still be repaid in the event of a disability.

If a disability prevents you from working, repaying your loan payments can be a problem. The Business Loan Plan will make payments on your business loans while you are disabled.

Request a Quote